By RSIR Staff | December 2, 2024

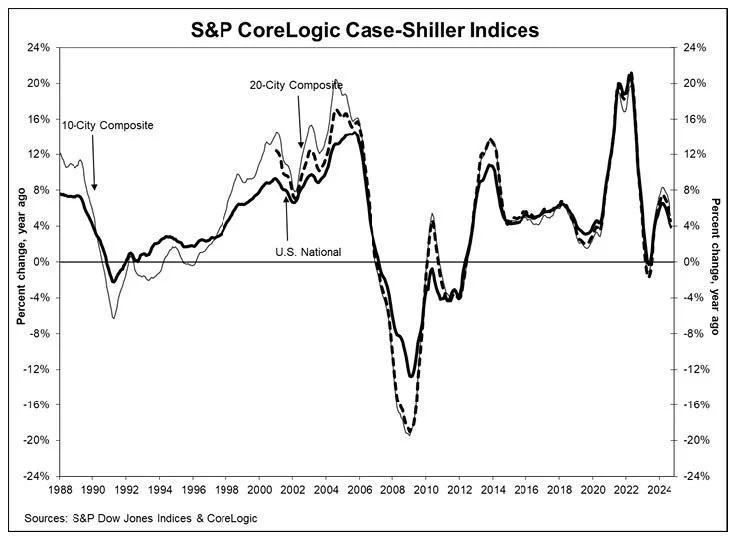

As the year comes to an end and we begin to prepare for a new year and potentially new real estate market conditions, the latest S&P/Case-Shiller Home Price Index report, released November 26, is an excellent starting point to chart the way forward towards buying or selling goals. Explore the report here.

As we dig into the released data, it reveals that overall, price growth decelerated through the end of Q3-2024, yet remains positive rising 3.9% year-over- year. A slow down may be led by the rising mortgage rates, noting the Fed didn’t drop the bank rate until the September meeting.

Locally, in the Seattle metro area, prices are climbing at half a point per month, which is a greater concern for would-be buyers that are watching higher mortgage rates. Additional rate cuts are anticipated and so buying sooner than later is more advised and you can simply refinance later if and when mortgage rates drop as hoped. Buyers can enjoy a lower mortgage payment but can’t renegotiate the purchase price, so timing the market on the buy is more important that securing a preferred mortgage rate.